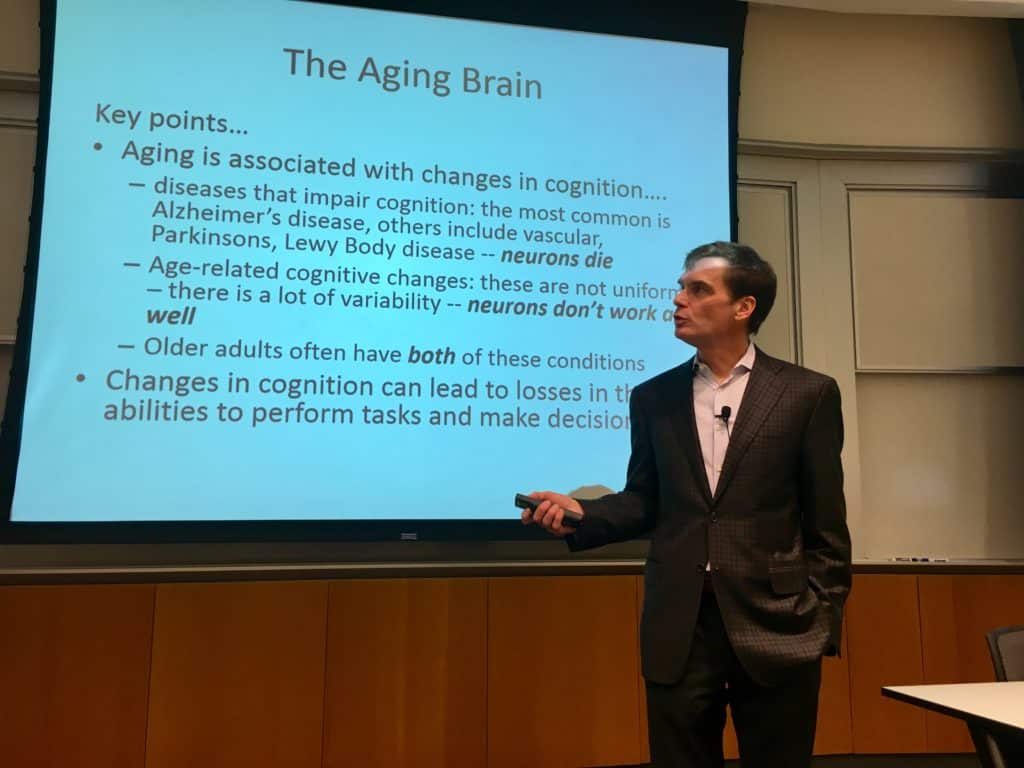

In an address to the Securities Industry Institute (SII) last month, Dr. Jason Karlawish told an audience of financial service industry professionals that they could be the first to notice a client’s developing cognitive impairment.

Karlawish, co-director of Penn Memory Center, addressed SII attendees at Huntsman Hall March 7. His presentation discussed his concept of “whealthcare” and the essential role of the services industry in the fight against Alzheimer’s disease.

As Karlawish conceived it, the term “whealthcare” speaks to the intersection between healthcare and wealth-centered industries, namely, banking and financial services.

“Financial decision-making demands a lot of our cognitive abilities and so it’s often one of the first signs that someone is experiencing cognitive problems from a disease like Alzheimer’s,” Karlawish noted on whealthcare.org. “If we start to look after people’s wealth, we can also effectively monitor their health.”

How would implementing “whealthcare” benefit the financial services industry? Alzheimer’s patients are especially vulnerable to financial exploitation. The financial abuse of seniors is responsible for an estimated $3 billion to $40 billion in total annual losses, according to The Consumer Financial Protection Bureau.

As such, it would be in the best interests of both firms and their senior clients to implement “whealthcare” through increased surveillance of financial capacity.

In his talk, Karlawish delineated the ways in which firms may accomplish more vigilant monitoring. He called for specialized staff training, increased communication between firms, clients, and families, and application of innovative technological solutions.

As an end goal, Karlawish hoped to use financial tracking both as a preliminary diagnostic measure for cognitive decline, and as a tool to combat the financial abuse and associated losses plaguing the financial services industry.

The Wharton School hosted SII in collaboration with the industry trade group Securities Industry and Financial Markets Association (SIFMA).

According to SIFMA, the SII institute has been “the premier executive development program for financial services professionals” for more than 65 years. Including sessions led by a number of industry executives and experts, the program curriculum is designed to equip participants with industry knowledge, investment knowledge, and professional skills.

— By Grace Ragi